Struggling to make your paycheck stretch? You’re not alone! Budgeting on a low income might feel impossible, but with the right plan, you can stay on top of bills, save money, and reduce financial stress. Even if you’re living paycheck to paycheck, these five easy steps will help you take control of your money—without feeling restricted. Let’s dive in and create a budget that actually works for you!

What is a Budget/Spending Plan?

Think of a budget as a guide that tells you exactly how every dollar should be spent.

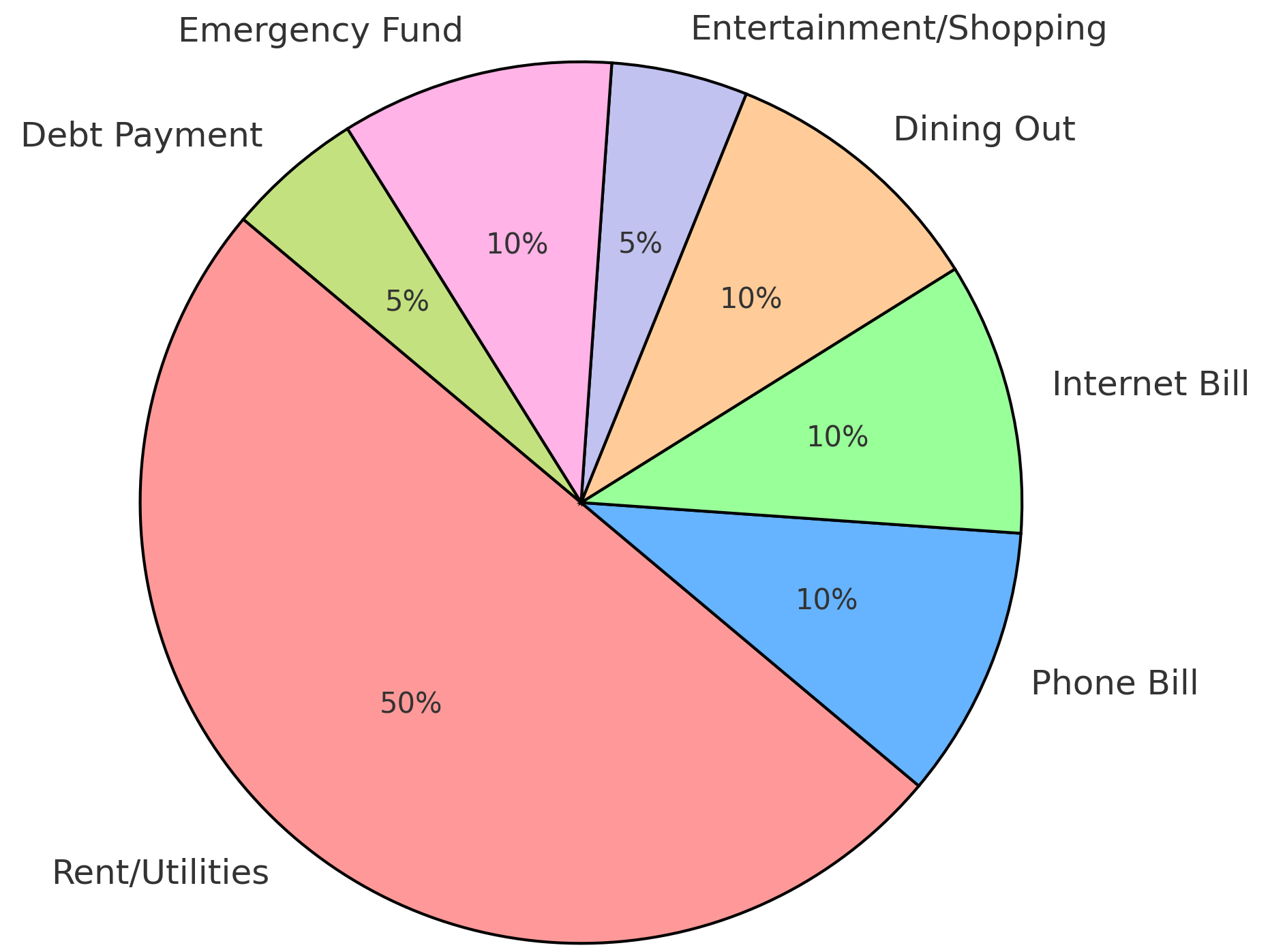

Example Budget Breakdown for $1,000 Paycheck

- 💰 Income: $1,000

Fixed Expenses (Essentials) – 70% ($700)

- ✅ Rent/Utilities: $500

- ✅ Phone Bill: $100

- ✅ Internet Bill: $100

Wants (Dining Out & Fun) – 15% ($150)

- 🍽️ Dining Out: $100

- 🎉 Entertainment/Shopping: $50

Savings & Debt – 15% ($150)

- 💰 Emergency Fund: $100

- 💳 Debt Payment (Extra Toward Loans/Credit Card): $50

Now that you have a basic example, let’s dive into how to get started.

1. Track Your Income & Expenses

Before creating a budget, you need to understand where your money is going.

- Write down all sources of income (paychecks, side hustles, benefits, etc.).

- List all expenses (rent, groceries, bills, transportation, debt payments).

- Use a budgeting app, spreadsheet, or notebook to track everything.

The great news is that if you sign up for the Mama’s Money Reset Newsletter, you will receive our free/custom Google Sheets Expense Tracker. This tool calculates your income and expenses and determines whether you were over or under your goals that month. (It is Based on a variation of the 70/20/10 rule.)

Want a Freebie?

Join The Reset Club and Get Our Free Automated Google Sheets Expense Tracker!

2. Prioritize Essential Expenses

Since your income is limited, focus on necessities first. Basically, What Do You Really Need?

- Needs First: Rent, utilities, food, and transportation should be covered before anything else.

- Cut Back on Non-Essentials: Reduce dining out, subscriptions, and impulse shopping.

- Negotiate Bills: Contact service providers to lower your bills or set up payment plans.

I recently refinanced my auto loan to lower my term (length of payments), to lower my interest rate ( 7.47% to 6.24%), and to lower my monthly payment. This helps reduce the amount of interest you would pay when the loan is done and free up extra dollars monthly that could be applied to savings or other debt.

Determining your Needs vs. Wants, like setting aside money for your rent biweekly or eating out for the third time this week, is key to budgeting and getting ahead of your finances. Creating a budget/spending plan isn’t just about what you can’t do, it’s also about properly preparing for what you want to do too.

3. Use the 70/20/10 Rule (or a Modified Version)

If your income is tight, adjusting this rule can help:

- 70% for Needs: Housing, utilities, groceries, and transportation.

- 20% for Wants: Entertainment, eating out, hobbies (adjust as needed).

- 10% for Savings & Debt: Emergency fund, savings, and paying off debt.

A modified version was used in the example above.

If you have a low income, applying the 70/20/10 rule may be more your speed. However, if you’re a little more comfortable with budgeting and have established one month of an emergency fund, you may consider trying the 50/30/20 rule instead (50% needs, 30% debt/savings, 20% wants).

Either way, you know your story best, so do what works best for you!

4. Find Ways to Increase Your Income

If your expenses outweigh your income, consider ways to earn extra money.

- Side Hustles: Selling handmade goods on Etsy, dog walking with Rover, Reselling Items like clothes, etc, or selling on Amazon KDP. (A post on this topic will be coming soon!)

- Job Advancement: Ask for a raise, take on extra shifts, work overtime if it’s offered, or upskill for better-paying jobs.

- Passive Income: Monetize a skill (YouTube, e-books, digital products, or blogging). P.S I already created a blog post on this topic for you as well. Passive Income Blog Post

You won’t be able to get ahead if your income is behind what you spend each month. Earning extra income could not only help you stay “afloat,” but it could also help you propel your Emergency Fund into the 1,3,6 rule ( 1, 3, or 6 months of Expenses Saved up).

5. Build an Emergency Fund & Pay Off Debt

Emergency Fund– you know, for when life’s going good and then the check engine light comes on?

Even on a low income, saving something/anything is crucial because it’s not IF something will happen; it’s WHEN it will happen, and you want to ensure you have something there to “cushion the blow“.

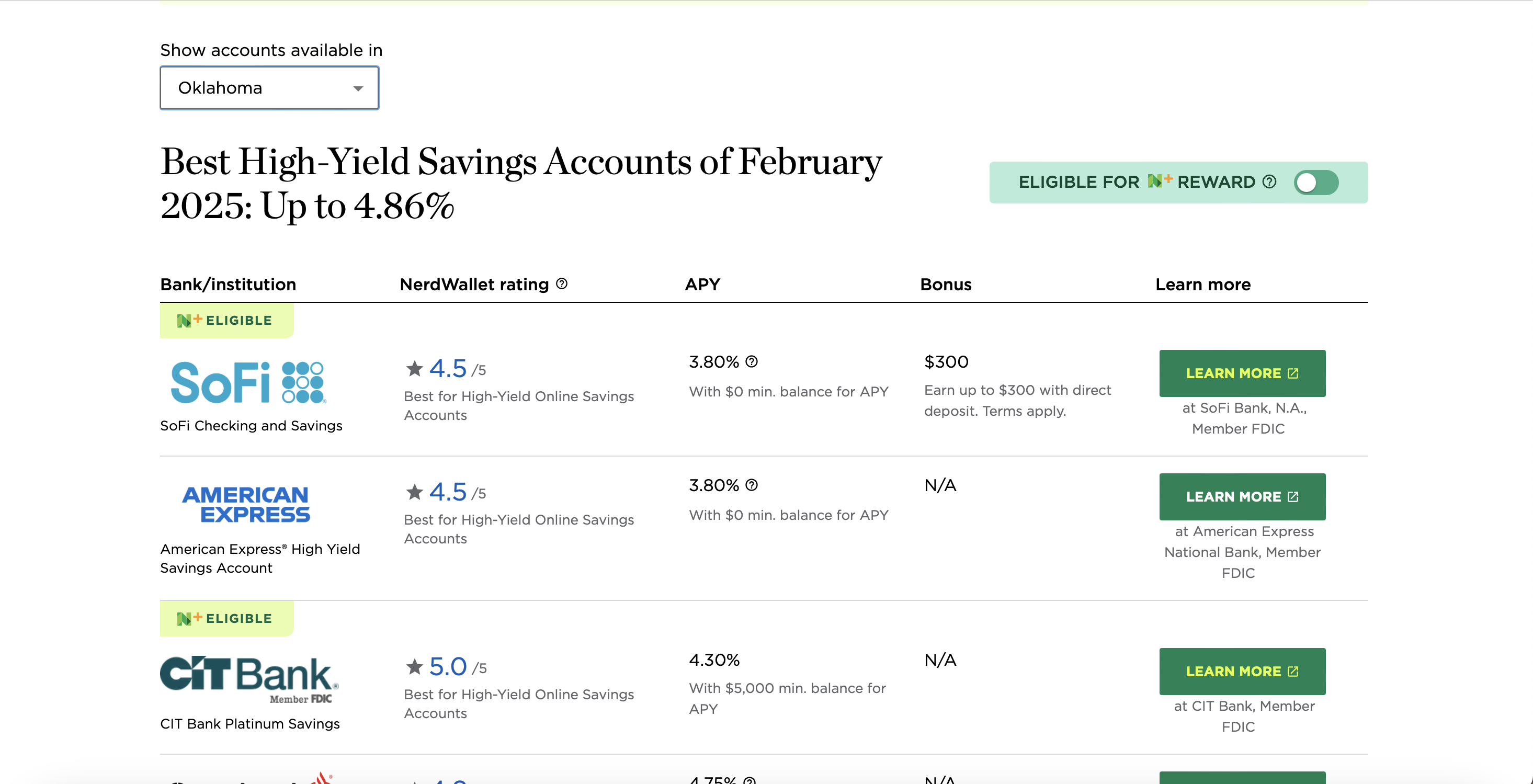

- Start Small: Save $5-$10 weekly in a high-yield savings account (HYSA). NerdWallet stays up-to-date with the best HYSAs monthly, depending on current rates, ease of opening, etc.

- Focus on High-Interest Debt: Pay off credit cards first to reduce financial strain. High-interest debt is typically anything over 10%, not including your vehicle.

- Use the Snowball or Avalanche Method:

Snowball: How It Works

Pay off the smallest debt first for motivation.

- Pay the minimum on all debts.

- Put any extra money towards the smallest balance.

- Once the smallest balance is paid off, use that extra money to attack the second-smallest balance.

- Continue this process until all debts are gone.

Avalanche: How It Works

Pay off the highest interest debt first to save money.

- Pay the minimum on all debts.

- Put any extra money towards the debt with the highest interest.

- Once the amount with the highest interest is paid off, tackle the second-highest balance.

- Finally, pay off the debt with the lowest interest balance.

Bonus Tip: Use Cash Envelopes

If you struggle with overspending, try cash budgeting. Put cash in envelopes for groceries, gas, and entertainment—once it’s gone, it’s gone!

That’s It!

You now have five basic steps to get started with budgeting and taking control of your finances. If you want to succeed at building wealth, you have to have a plan and the discipline to stick to it. It won’t necessarily be easy, but I’m right here with you, and I know you can do it!

Challenge: Pull up your bank statement from last month, highlight, and calculate how much you spent on non-essential items (dining out, subscriptions, impulse shopping, etc). This will help you get a clear picture of your spending habits, and I’m curious to know if you spent over $150 on dining out like I did, so feel free to add that to the comments below.

Reminder: Don’t forget to sign up for the Mama’s Money Reset Newsletter to get regular updates directly to your inbox and your Free Expense Tracker.

See you in the next post, where I will discuss “50 Quality Fashion Finds to Elevate Your Closet.” Bye ❤